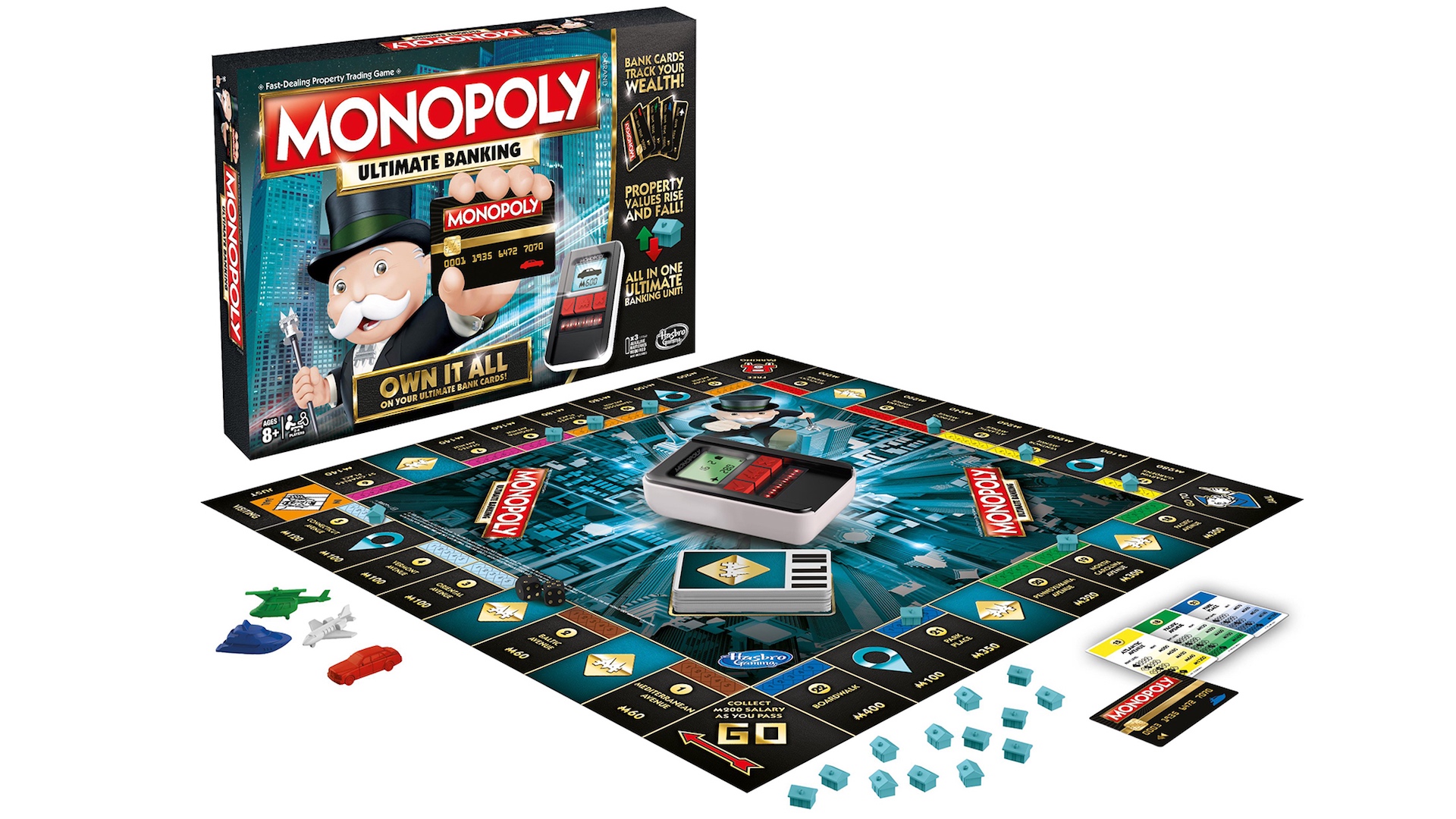

Monopoly is a classic board game that has been around for over 80 years. The game is all about buying and selling properties, and the ultimate goal is to become the richest player. In the game, players can buy properties and charge rent to other players who land on their spaces. The game is a lot of fun, but in real life, selling property to a bank can be a serious matter.

What Does It Mean to Sell Property to a Bank?

Selling property to a bank means that you are essentially giving up ownership of the property in exchange for cash. This is a common practice for people who are struggling to make their mortgage payments or who need to get out of a difficult financial situation. When you sell a property to a bank, they will typically pay you a lump sum of cash and take over ownership of the property.

Why Would Someone Sell Property to a Bank?

:max_bytes(150000):strip_icc()/monopoly_railroads_02-b2f336710cde43b184e7a0edbefbc6d1.jpg)

There are many reasons why someone might sell their property to a bank. One of the most common reasons is because they are having trouble making their mortgage payments. If you are behind on your mortgage payments, selling your property to the bank can be a way to get out of debt and avoid foreclosure.

Another reason why someone might sell their property to a bank is because they need cash quickly. If you have equity in your property, selling it to the bank can be a way to access that equity and get the cash you need to pay off debts or cover unexpected expenses.

How Does Selling Property to a Bank Work?

If you are considering selling your property to a bank, the first step is to contact the bank and let them know that you are interested in selling. The bank will typically send an appraiser to assess the value of the property and determine how much they are willing to offer you for it.

Once you agree on a price, the bank will take over ownership of the property and you will receive the agreed-upon cash payment. It is important to note that when you sell your property to a bank, you will typically receive less money than if you were to sell it on the open market.

What Are the Pros and Cons of Selling Property to a Bank?

Like any financial decision, selling your property to a bank has its pros and cons. Some of the pros of selling to a bank include:

- Getting cash quickly

- Avoiding foreclosure

- Reducing debt

Some of the cons of selling to a bank include:

- Receiving less money than if you were to sell on the open market

- Losing ownership of the property

- Missing out on potential future profits if the property increases in value

Conclusion

Selling property to a bank can be a good option for those who are struggling financially or need cash quickly. However, it is important to weigh the pros and cons before making a decision. If you are considering selling your property to a bank, be sure to do your research and talk to a financial advisor to make sure it is the right decision for you.